Table of Content

You're eligible for disability income but receive active-duty or retirement pay. For Veteran and active duty residents of New Orleans, Baton Rouge, and Shreveport VA Loans are the preferred path to home ownership. Most applicants are pre-approved quickly and can begin looking for a home with their family the day they are pre-approved.

These letters provide documented proof of the applicant's history of service and whether they are entitled to a VA loan. VA borrowers in Louisiana should also consider the cost and impact of VA loan limits and property taxes when making their home purchase. Peacetime service of at least 181 days of continuous active duty with no dishonorable discharge. If you were discharged earlier due to a service-connected disability, you should speak with the regional VA office to verify eligibility. When buying a home, almost every lender will want to know where your down payment came from.

Check VA Loan Eligibility

Most of the time the buyer’s agent doesn’t cost the buyer anything. However if you purchase a home not listed with a realtor they may not be willing to compensate your realtor. VA cash-out refinance – Any veteran with eligibility can use the VA cash-out refinance.

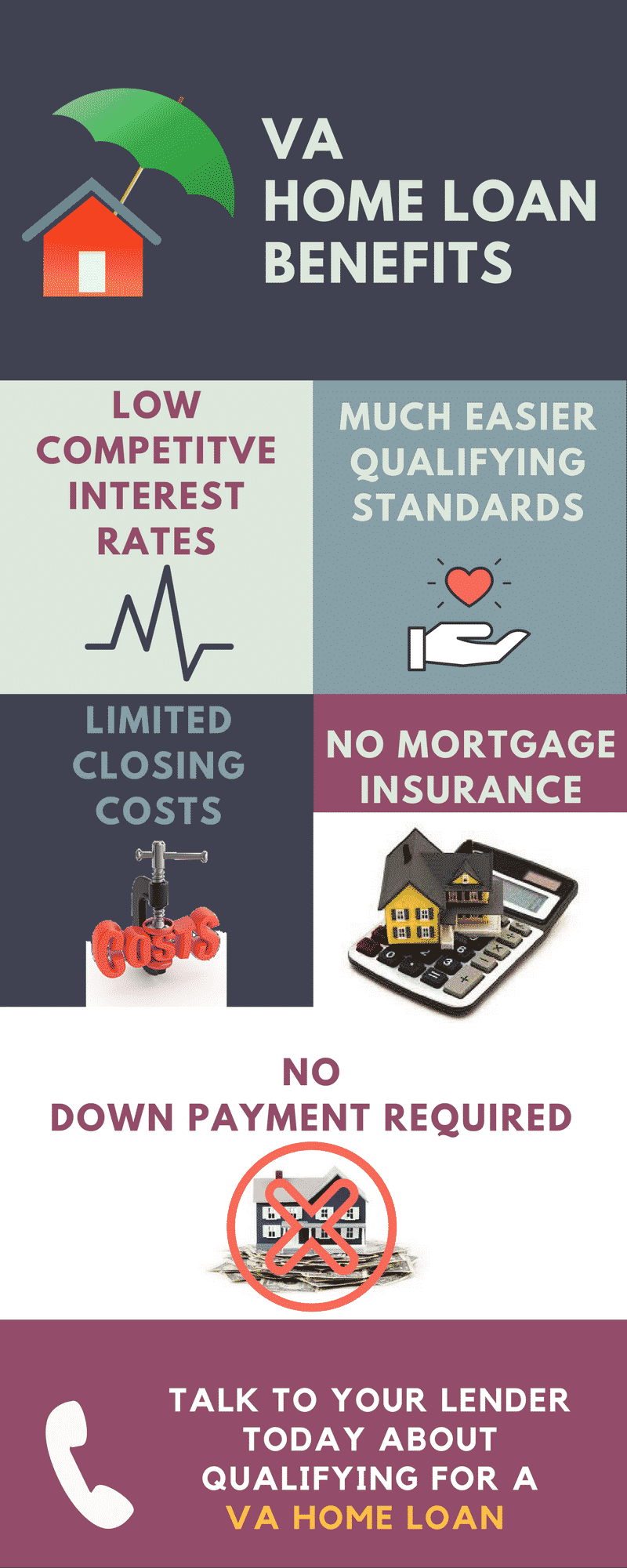

It guarantees the lender up to 25% of the loan amount in case of default, and is the reason they are able to offer veterans a no-money-down loan program. Since VA loans are guaranteed by the VA, they do not require mortgage insurance. Unlike VA mortgages, which are backed by the Department of Veterans Affairs, VA small business loans are partially guaranteed by the Small Business Administration. The SBA is a government agency with the purpose of driving entrepreneurship and fostering the development of small businesses.

Home Loan Pre-Qualification Inquiry

VALoans.com is not affiliated with or endorsed by the Department of Veterans Affairs or any government agency. Visitors with questions regarding our licensing may visit the Nationwide Mortgage Licensing System & Directory for more information. Channing was very helpful answering any questions that I had, as a first time home buyer, about the whole process and any questions that came up with the figures.

Using a VA loan in Louisiana has many benefits for seasoned and first-time homebuyers alike. This is a private website that is not affiliated with the U.S. government, U.S. U.S. government agencies have not reviewed this information.

VA Loan Calculator

Neither Mortgage Research Center nor ICB Solutions guarantees that you will be eligible for a loan through the VA loan program. VALoans.com will not charge, seek or accept fees of any kind from you. VA loans are one of the best options available for veterans that would like to purchase a home or refinance their current VA mortgage. The VA program allows veterans to purchase a home with no down payment and 100% financing. In addition to this monthly mortgage insurance is not required which makes the VA program one of the most affordable options available.

VA Home Loans are provided by private lenders, such as banks and mortgage companies. VA guarantees a portion of the loan, enabling the lender to provide you with more favorable terms. Requirements for VA mortgages are generally set along the same lines as conventional home loans. In addition to functioning electrical and plumbing systems, your target property will need to have a safe source of water.

Famed explorer Hernando de Soto later navigated the state, coming into contact with the Caddo and Tunica tribes. The first permanent settlement in the state was established by France in the late 17th century. Following their defeat during the Seven Years War, France transferred control of the area to Spain. Eventually, the territory was re-ceded to France under Napoleon Bonaparte, before being sold to the United States in 1803 as the Louisiana Purchase. The territory would be split to form 15 separate states, as well as two Canadian provinces.

Depending on the applicant's service history and current status, the conditions for providing proof of service can vary. Our mission is to provide anyone with VA eligibility the best mortgage possible in the state of Louisiana. Saving enough money for a down payment can be especially difficult for active duty service members who are moving from base to base. Since there is no down payment required for a VA Home Loan, many veterans can purchase a home with little to no money out of pocket.

This helps reduce the amount of cash you need out of pocket at the closing. If you defaulted on a VA home loan, you lose that portion of your entitlement. Typically, you need two years of ‘clean credit’ to qualify. This means two years from the date of the bankruptcy discharge or the foreclosure sale.

Your VA loan entitlement is actually a guarantee for lenders. Before you buy, be sure to read the VA Home Loan Buyer's Guide. This guide can help you under the homebuying process and how to make the most of your VA loan benefit.Download the Buyer's Guide here. You can obtain a VA loan for a manufactured or modular home with Guaranteed Rate in all states, single-wide manufactured homes and leasehold properties not included. Like all VA loans, you need a Certificate of Eligibility and proof of service.

If a veteran is already in a VA loan they can take advantage of a reduced documentation refinance by using the streamline program to lower their payments. VA streamline refinance – If you have a current VA loan and just want to lower the interest rate or change the term, the VA streamline program is an option. You don’t have to verify your qualifying requirements for this program. The VA requires on-time mortgage payments and a benefit for refinancing – that’s it. Some lenders may have additional requirements, which we will walk you through.

No comments:

Post a Comment